Page 314 - FR Integrated Workbook 2018-19

P. 314

Chapter 22

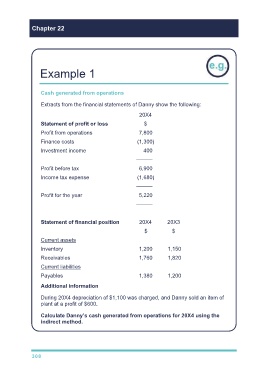

Example 1

Cash generated from operations

Extracts from the financial statements of Danny show the following:

20X4

Statement of profit or loss $

Profit from operations 7,800

Finance costs (1,300)

Investment income 400

———

Profit before tax 6,900

Income tax expense (1,680)

———

Profit for the year 5,220

———

Statement of financial position 20X4 20X3

$ $

Current assets

Inventory 1,200 1,150

Receivables 1,760 1,820

Current liabilities

Payables 1,380 1,200

Additional information

During 20X4 depreciation of $1,100 was charged, and Danny sold an item of

plant at a profit of $600.

Calculate Danny’s cash generated from operations for 20X4 using the

indirect method.

308