Page 317 - FR Integrated Workbook 2018-19

P. 317

Statement of cash flows

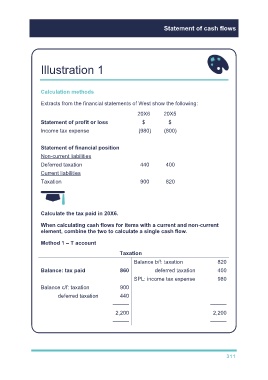

Illustration 1

Calculation methods

Extracts from the financial statements of West show the following:

20X6 20X5

Statement of profit or loss $ $

Income tax expense (980) (800)

Statement of financial position

Non-current liabilities

Deferred taxation 440 400

Current liabilities

Taxation 900 820

Calculate the tax paid in 20X6.

When calculating cash flows for items with a current and non-current

element, combine the two to calculate a single cash flow.

Method 1 – T account

Taxation

Balance b/f: taxation 820

Balance: tax paid 860 deferred taxation 400

SPL: income tax expense 980

Balance c/f: taxation 900

deferred taxation 440

——— ———

2,200 2,200

——— ———

311