Page 318 - FR Integrated Workbook 2018-19

P. 318

Chapter 22

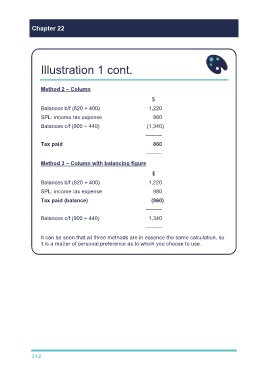

Illustration 1 cont.

Method 2 – Column

$

Balances b/f (820 + 400) 1,220

SPL: income tax expense 980

Balances c/f (900 + 440) (1,340)

———

Tax paid 860

———

Method 3 – Column with balancing figure

$

Balances b/f (820 + 400) 1,220

SPL: income tax expense 980

Tax paid (balance) (860)

———

Balances c/f (900 + 440) 1,340

———

It can be seen that all three methods are in essence the same calculation, so

it is a matter of personal preference as to which you choose to use.

312