Page 479 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 479

Business valuations and market efficiency

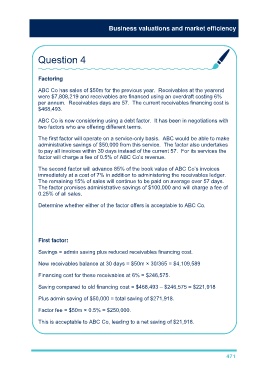

Question 4

Factoring

ABC Co has sales of $50m for the previous year. Receivables at the yearend

were $7,808,219 and receivables are financed using an overdraft costing 6%

per annum. Receivables days are 57. The current receivables financing cost is

$468,493.

ABC Co is now considering using a debt factor. It has been in negotiations with

two factors who are offering different terms.

The first factor will operate on a service-only basis. ABC would be able to make

administrative savings of $50,000 from this service. The factor also undertakes

to pay all invoices within 30 days instead of the current 57. For its services the

factor will charge a fee of 0.5% of ABC Co’s revenue.

The second factor will advance 85% of the book value of ABC Co’s invoices

immediately at a cost of 7% in addition to administering the receivables ledger.

The remaining 15% of sales will continue to be paid on average over 57 days.

The factor promises administrative savings of $100,000 and will charge a fee of

0.25% of all sales.

Determine whether either of the factor offers is acceptable to ABC Co.

First factor:

Savings = admin saving plus reduced receivables financing cost.

New receivables balance at 30 days = $50m × 30/365 = $4,109,589

Financing cost for these receivables at 6% = $246,575.

Saving compared to old financing cost = $468,493 – $246,575 = $221,918

Plus admin saving of $50,000 = total saving of $271,918.

Factor fee = $50m × 0.5% = $250,000.

This is acceptable to ABC Co, leading to a net saving of $21,918.

471