Page 482 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 482

Chapter 20

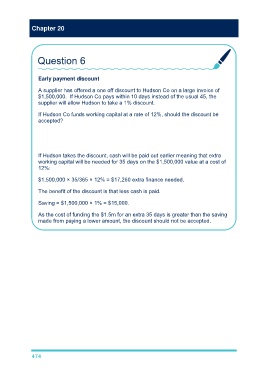

Question 6

Early payment discount

A supplier has offered a one off discount to Hudson Co on a large invoice of

$1,500,000. If Hudson Co pays within 10 days instead of the usual 45, the

supplier will allow Hudson to take a 1% discount.

If Hudson Co funds working capital at a rate of 12%, should the discount be

accepted?

If Hudson takes the discount, cash will be paid out earlier meaning that extra

working capital will be needed for 35 days on the $1,500,000 value at a cost of

12%:

$1,500,000 × 35/365 × 12% = $17,260 extra finance needed.

The benefit of the discount is that less cash is paid.

Saving = $1,500,000 × 1% = $15,000.

As the cost of funding the $1.5m for an extra 35 days is greater than the saving

made from paying a lower amount, the discount should not be accepted.

474