Page 532 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 532

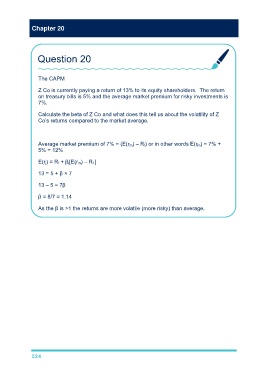

Chapter 20

Question 20

The CAPM

Z Co is currently paying a return of 13% to its equity shareholders. The return

on treasury bills is 5% and the average market premium for risky investments is

7%.

Calculate the beta of Z Co and what does this tell us about the volatility of Z

Co’s returns compared to the market average.

Average market premium of 7% = (E(r m) – R f) or in other words E(r m) = 7% +

5% = 12%

E(r j) = R f + β i[E(r m) – R f ]

13 = 5 + β × 7

13 – 5 = 7β

β = 8/7 = 1.14

As the β is >1 the returns are more volatile (more risky) than average.

524