Page 537 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 537

Business valuations and market efficiency

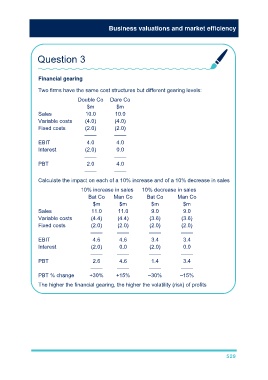

Question 3

Financial gearing

Two firms have the same cost structures but different gearing levels:

Double Co Dare Co

$m $m

Sales 10.0 10.0

Variable costs (4.0) (4.0)

Fixed costs (2.0) (2.0)

–––– ––––

EBIT 4.0 4.0

Interest (2.0) 0.0

–––– ––––

PBT 2.0 4.0

–––– ––––

Calculate the impact on each of a 10% increase and of a 10% decrease in sales

10% increase in sales 10% decrease in sales

Bat Co Man Co Bat Co Man Co

$m $m $m $m

Sales 11.0 11.0 9.0 9.0

Variable costs (4.4) (4.4) (3.6) (3.6)

Fixed costs (2.0) (2.0) (2.0) (2.0)

–––– –––– –––– ––––

EBIT 4.6 4.6 3.4 3.4

Interest (2.0) 0.0 (2.0) 0.0

–––– –––– –––– ––––

PBT 2.6 4.6 1.4 3.4

–––– –––– –––– ––––

PBT % change +30% +15% –30% –15%

The higher the financial gearing, the higher the volatility (risk) of profits

529