Page 535 - Microsoft Word - 00 ACCA F9 IWB prelims 2017.docx

P. 535

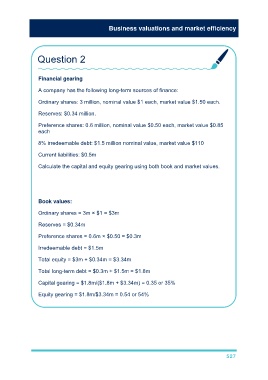

Business valuations and market efficiency

Question 2

Financial gearing

A company has the following long-term sources of finance:

Ordinary shares: 3 million, nominal value $1 each, market value $1.50 each.

Reserves: $0.34 million.

Preference shares: 0.6 million, nominal value $0.50 each, market value $0.85

each

8% irredeemable debt: $1.5 million nominal value, market value $110

Current liabilities: $0.5m

Calculate the capital and equity gearing using both book and market values.

Book values:

Ordinary shares = 3m × $1 = $3m

Reserves = $0.34m

Preference shares = 0.6m × $0.50 = $0.3m

Irredeemable debt = $1.5m

Total equity = $3m + $0.34m = $3.34m

Total long-term debt = $0.3m + $1.5m = $1.8m

Capital gearing = $1.8m/($1.8m + $3.34m) = 0.35 or 35%

Equity gearing = $1.8m/$3.34m = 0.54 or 54%

527