Page 5 - AMANGO MODEL ANSWER 2

P. 5

P a ge | 5

Team CharterCapital Advisory,

The CharterQuest Institute

B. DETAILED REPORT

B1. SYNERGY AND CORPORATE ACQUISITION

The takeover offer from VR, depending on how it is assessed, presents an opportunity or threat (see

SWOT analysis -Appendix 1), yet it has an embedded ethical dilemma (see B6.1 of this report). As

a board, our overarching duty is to our shareholders, obviously, balanced with other stakeholders’

expectations, especially our employees. VR itself is a 20% shareholder and they are seeking to

acquire 60% control at a 50% premium. This premium sounds too attractive or too good to be true!

Given that it is a share-for-share exchange they are proposing, we need to do a valuation of the

potential synergies, as should this not realise, then the premium is worthless; but also, we need to

do a high level due diligence on VR’s ability to integrate the two businesses and realise the

proposed synergies!

1. Premium, revenue synergies and terms of the exchange

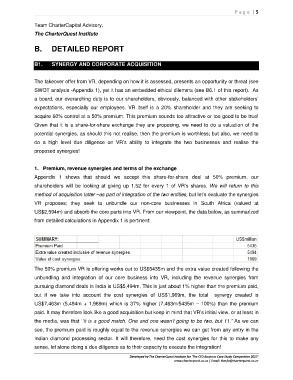

Appendix 1 shows that should we accept this share-for-share deal at 50% premium, our

shareholders will be looking at giving up 1.52 for every 1 of VR’s shares. We will return to this

method of acquisition latter –as part of integration of the two entities, but let’s evaluate the synergies

VR proposes; they seek to unbundle our non-core businesses in South Africa (valued at

US$2,594m) and absorb the core parts into VR. From our viewpoint, the data below, as summarized

from detailed calculations in Appendix 1 is pertinent:

The 50% premium VR is offering works out to US$5435m and the extra value created following the

unbundling and integration of our core business into VR, including the revenue synergies from

pursuing diamond deals in India is US$5,494m. This is just about 1% higher than the premium paid,

but if we take into account the cost synergies of US$1,969m, the total synergy created is

US$7,463m (5,494m + 1,969m) which is 37% higher (7,463m/5435m – 100%) than the premium

paid. It may therefore look like a good acquisition but keep in mind that VR’s initial view, or at least in

the media, was that ‘’it is a good match. One and one wasn’t going to be two, but 11.” As we can

see, the premium paid is roughly equal to the revenue synergies we can get from any entry in the

Indian diamond processing sector. It will therefore, need the cost synergies for this to make any

sense, let alone doing a due diligence as to their capacity to execute the integration!

Developed by The CharterQuest Institute for 'The CFO Business Case Study Competition 2017'

www.charterquest.co.za | Email: thecfo@charterquest.co.za