Page 27 - MCOM MODEL ANSWER 1

P. 27

P a g e | 27

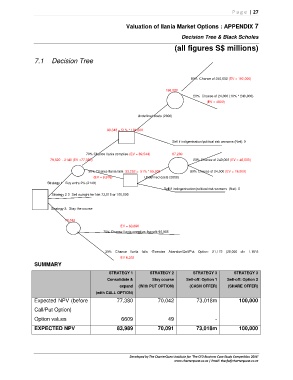

Valuation of Ilania Market Options : APPENDIX 7

Decision Tree & Black Scholes

(all figures S$ millions)

7.1 Decision Tree

80% Chance of 240,000 (EV = 192,000)

196,800

20% Chance of 24,000 (10% * 240,000)

(EV = 4800)

Undefined costs (2000)

99,348 = 51% * 194,800

Sell if indigenisation/political risk worsens (Net): 0

70% Chance Ilania complies (EV = 69,544) 67,200

79,520 - 2140 (EV =77,380) 20% Chance of 240,000 (EV = 48,000)

30% Chance Ilania fails 33,252 = 51% * 65,200 80% Chance of 24,000 (EV = 19,200)

(EV = 9,976) Undefined costs (2000)

Strategy 1 Buy extra 2% (2140)

Sell if indingenisation/political risk worsens (Net): 0

Strategy 2 3 -Sell outright for Net 73,018 or 100,000

Strategy 3: Stay the course

70,042

EV = 63,690

70% Chance Ilania complies: benefit 90,985

30% Chance Ilania fails -Exercise Abandon/Sell/Put Option: 21,172 (28,000 div 1.15^2

EV 6,352

SUMMARY

STRATEGY 1 STRATEGY 2 STRATEGY 3 STRATEGY 3

Consolidate & Stay course Sell-off: Option 1 Sell-off: Option 2

expand (With PUT OPTION) (CASH OFFER) (SHARE OFFER)

(with CALL OPTION)

Expected NPV (before 77,380 70,042 73,018m 100,000

Call/Put Option)

Option values 6609 49 -

EXPECTED NPV 83,989 70,091 73,018m 100,000

Developed by The CharterQuest Institute for 'The CFO Business Case Study Competition 2016'

www.charterquest.co.za | Email: thecfo@charterquest.co.za