Page 22 - MCOM MODEL ANSWER 1

P. 22

P a g e | 22

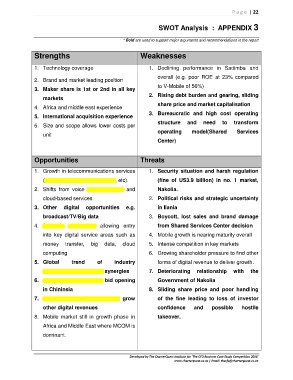

SWOT Analysis : APPENDIX 3

* Bold are used to support major arguments and recommendations in the report

Strengths Weaknesses

1. Technology coverage 1. Declining performance in Sadimba and

overall (e.g. poor ROE at 23% compared

2. Brand and market leading position

to V-Mobile of 56%)

3. Maker share is 1st or 2nd in all key

2. Rising debt burden and gearing, sliding

markets

share price and market capitalisation

4. Africa and middle east experience

3. Bureaucratic and high cost operating

5. International acquisition experience

structure and need to transform

6. Size and scope allows lower costs per

operating model(Shared Services

unit

Center)

Opportunities Threats

1. Growth in telecommunications services 1. Security situation and harsh regulation

(mobile money, e/m commerce, etc). (fine of US3.9 billion) in no. 1 market,

2. Shifts from voice to data/internet and Nakolia.

cloud-based services 2. Political risks and strategic uncertainty

3. Other digital opportunities e.g. in Ilania

broadcast/TV/Big data 3. Boycott, lost sales and brand damage

4. Strategic agreements allowing entry from Shared Services Center decision

into key digital service areas such as 4. Mobile growth is nearing maturity overall

money transfer, big data, cloud 5. Intense competition in key markets

computing 6. Growing shareholder pressure to find other

5. Global trend of industry forms of digital revenue to deliver growth.

consolidation to release synergies 7. Deteriorating relationship with the

6. Mobile operator license bid opening Government of Nakolia

in Chininsia 8. Sliding share price and poor handling

7. Acquisition of CloudNet and grow of the fine leading to loss of investor

other digital revenues confidence and possible hostile

8. Mobile market still in growth phase in takeover.

Africa and Middle East where MCOM is

dominant.

Developed by The CharterQuest Institute for 'The CFO Business Case Study Competition 2016'

www.charterquest.co.za | Email: thecfo@charterquest.co.za