Page 311 - BA2 Integrated Workbook STUDENT 2018

P. 311

Answers to supplementary objective test questions

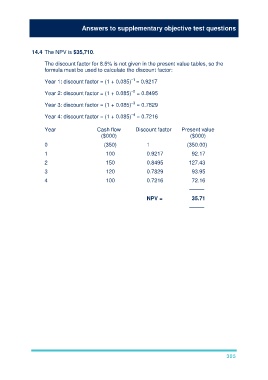

14.4 The NPV is $35,710.

The discount factor for 8.5% is not given in the present value tables, so the

formula must be used to calculate the discount factor:

–1

Year 1: discount factor = (1 + 0.085) = 0.9217

–2

Year 2: discount factor = (1 + 0.085) = 0.8495

–3

Year 3: discount factor = (1 + 0.085) = 0.7829

–4

Year 4: discount factor = (1 + 0.085) = 0.7216

Year Cash flow Discount factor Present value

($000) ($000)

0 (350) 1 (350.00)

1 100 0.9217 92.17

2 150 0.8495 127.43

3 120 0.7829 93.95

4 100 0.7216 72.16

–––––

NPV = 35.71

–––––

305