Page 308 - BA2 Integrated Workbook STUDENT 2018

P. 308

Fundamentals of Management Accounting

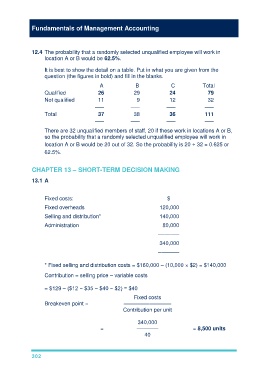

12.4 The probability that a randomly selected unqualified employee will work in

location A or B would be 62.5%.

It is best to show the detail on a table. Put in what you are given from the

question (the figures in bold) and fill in the blanks.

A B C Total

Qualified 26 29 24 79

Not qualified 11 9 12 32

––– ––– ––– –––

Total 37 38 36 111

––– ––– ––– –––

There are 32 unqualified members of staff, 20 if these work in locations A or B,

so the probability that a randomly selected unqualified employee will work in

location A or B would be 20 out of 32. So the probability is 20 ÷ 32 = 0.625 or

62.5%.

CHAPTER 13 – SHORT-TERM DECISION MAKING

13.1 A

Fixed costs: $

Fixed overheads 120,000

Selling and distribution* 140,000

Administration 80,000

–––––––

340,000

–––––––

* Fixed selling and distribution costs = $160,000 – (10,000 × $2) = $140,000

Contribution = selling price – variable costs

= $129 – ($12 − $35 − $40 − $2) = $40

Fixed costs

Breakeven point = ——–––––————

Contribution per unit

340,000

= ———— = 8,500 units

40

302