Page 305 - BA2 Integrated Workbook STUDENT 2018

P. 305

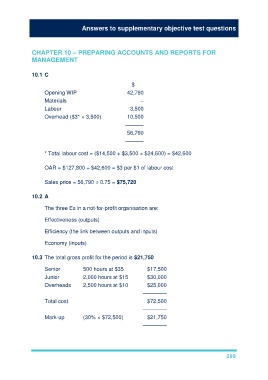

Answers to supplementary objective test questions

CHAPTER 10 – PREPARING ACCOUNTS AND REPORTS FOR

MANAGEMENT

10.1 C

$

Opening WIP 42,790

Materials –

Labour 3,500

Overhead ($3* × 3,500) 10,500

––––––

56,790

––––––

* Total labour cost = ($14,500 + $3,500 + $24,600) = $42,600

OAR = $127,800 ÷ $42,600 = $3 per $1 of labour cost

Sales price = 56,790 ÷ 0.75 = $75,720

10.2 A

The three Es in a not-for-profit organisation are:

Effectiveness (outputs)

Efficiency (the link between outputs and inputs)

Economy (inputs)

10.3 The total gross profit for the period is $21,750

Senior 500 hours at $35 $17,500

Junior 2,000 hours at $15 $30,000

Overheads 2,500 hours at $10 $25,000

––––––––

Total cost $72,500

––––––––

Mark-up (30% × $72,500) $21,750

––––––––

299