Page 76 - BA2 Integrated Workbook STUDENT 2018

P. 76

Chapter 4

Reciprocal servicing

In our example of apportionment and reapportionment, there was only one service

cost centre. In many examples there will be more than one and this can create a

complication when it comes to reapportionment of overheads from the service cost

centres to the production cost centres. The complication arises when the service cost

centres use each other’s services.

For example, if two services cost centres were canteen and maintenance, it is

possible that the maintenance staff could use the services of the canteen and should

therefore pick up a share of the canteen’s costs. It is also possible that the canteen

uses the services of the maintenance department and should therefore also pick up a

share of the maintenance department costs. This is known as reciprocal servicing.

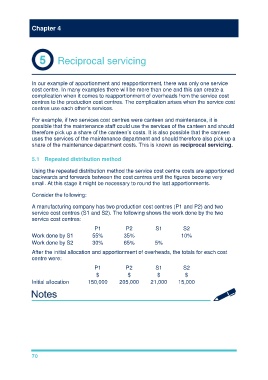

5.1 Repeated distribution method

Using the repeated distribution method the service cost centre costs are apportioned

backwards and forwards between the cost centres until the figures become very

small. At this stage it might be necessary to round the last apportionments.

Consider the following:

A manufacturing company has two production cost centres (P1 and P2) and two

service cost centres (S1 and S2). The following shows the work done by the two

service cost centres:

P1 P2 S1 S2

Work done by S1 55% 35% 10%

Work done by S2 30% 65% 5%

After the initial allocation and apportionment of overheads, the totals for each cost

centre were:

P1 P2 S1 S2

$ $ $ $

Initial allocation 150,000 205,000 21,000 15,000

70