Page 96 - BA2 Integrated Workbook STUDENT 2018

P. 96

Chapter 5

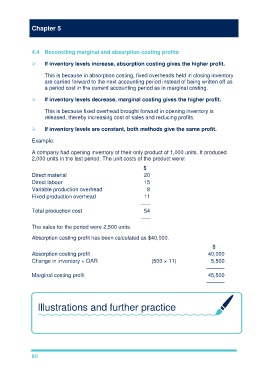

4.4 Reconciling marginal and absorption costing profits

If inventory levels increase, absorption costing gives the higher profit.

This is because in absorption costing, fixed overheads held in closing inventory

are carried forward to the next accounting period instead of being written off as

a period cost in the current accounting period as in marginal costing.

If inventory levels decrease, marginal costing gives the higher profit.

This is because fixed overhead brought forward in opening inventory is

released, thereby increasing cost of sales and reducing profits.

If inventory levels are constant, both methods give the same profit.

Example:

A company had opening inventory of their only product of 1,000 units. It produced

2,000 units in the last period. The unit costs of the product were:

$

Direct material 20

Direct labour 15

Variable production overhead 8

Fixed production overhead 11

–––

Total production cost 54

–––

The sales for the period were 2,500 units.

Absorption costing profit has been calculated as $40,000.

$

Absorption costing profit 40,000

Change in inventory × OAR (500 × 11) 5,500

––––––

Marginal costing profit 45,500

––––––

Illustrations and further practice

Now try TYU 4

90