Page 4 - FINAL CFA I SLIDES JUNE 2019 DAY 9

P. 4

Session Unit 8:

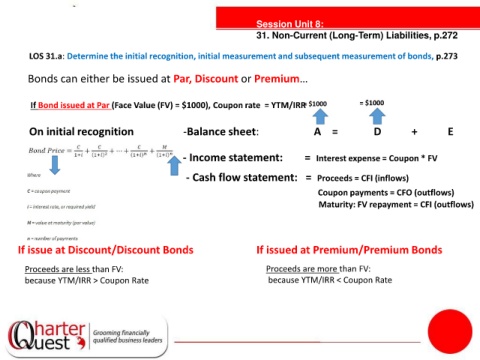

31. Non-Current (Long-Term) Liabilities, p.272

LOS 31.a: Determine the initial recognition, initial measurement and subsequent measurement of bonds, p.273

Bonds can either be issued at Par, Discount or Premium…

If Bond issued at Par (Face Value (FV) = $1000), Coupon rate = YTM/IRR

On initial recognition -Balance sheet: A = D + E

tanties

- Income statement: = Interest expense = Coupon * FV

- Cash flow statement: = Proceeds = CFI (inflows)

Coupon payments = CFO (outflows)

Maturity: FV repayment = CFI (outflows)

If issue at Discount/Discount Bonds If issued at Premium/Premium Bonds

Proceeds are less than FV: Proceeds are more than FV:

because YTM/IRR > Coupon Rate because YTM/IRR < Coupon Rate