Page 6 - FINAL CFA I SLIDES JUNE 2019 DAY 9

P. 6

Session Unit 8:

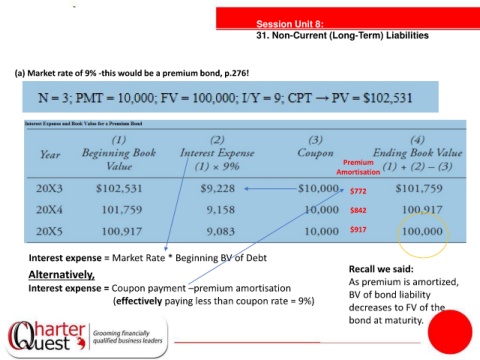

31. Non-Current (Long-Term) Liabilities

(a) Market rate of 9% -this would be a premium bond, p.276!

tanties Premium

Amortisation

$772

$842

$917

Interest expense = Market Rate * Beginning BV of Debt

Recall we said:

Alternatively,

As premium is amortized,

Interest expense = Coupon payment –premium amortisation

(effectively paying less than coupon rate = 9%) BV of bond liability

decreases to FV of the

bond at maturity.