Page 7 - FINAL CFA I SLIDES JUNE 2019 DAY 9

P. 7

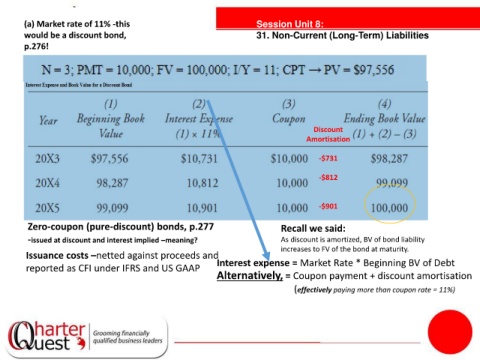

(a) Market rate of 11% -this Session Unit 8:

would be a discount bond, 31. Non-Current (Long-Term) Liabilities

p.276!

Discount

Amortisation

tanties -$731

-$812

-$901

Zero-coupon (pure-discount) bonds, p.277 Recall we said:

-issued at discount and interest implied –meaning? As discount is amortized, BV of bond liability

increases to FV of the bond at maturity.

Issuance costs –netted against proceeds and

reported as CFI under IFRS and US GAAP Interest expense = Market Rate * Beginning BV of Debt

Alternatively, = Coupon payment + discount amortisation

(effectively paying more than coupon rate = 11%)