Page 8 - FINAL CFA I SLIDES JUNE 2019 DAY 9

P. 8

Session Unit 8:

31. Non-Current (Long-Term) Liabilities

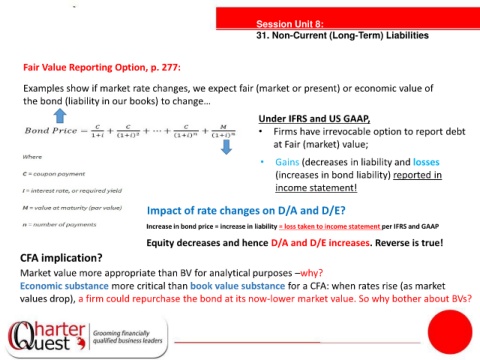

Fair Value Reporting Option, p. 277:

Examples show if market rate changes, we expect fair (market or present) or economic value of

the bond (liability in our books) to change…

Under IFRS and US GAAP,

• Firms have irrevocable option to report debt

at Fair (market) value;

tanties

•

Gains (decreases in liability and losses

(increases in bond liability) reported in

income statement!

Impact of rate changes on D/A and D/E?

Increase in bond price = increase in liability = loss taken to income statement per IFRS and GAAP

Equity decreases and hence D/A and D/E increases. Reverse is true!

CFA implication?

Market value more appropriate than BV for analytical purposes –why?

Economic substance more critical than book value substance for a CFA: when rates rise (as market

values drop), a firm could repurchase the bond at its now-lower market value. So why bother about BVs?