Page 101 - FINAL CFA SLIDES DECEMBER 2018 DAY 3

P. 101

Session Unit 3:

10. Common Probability Distributions

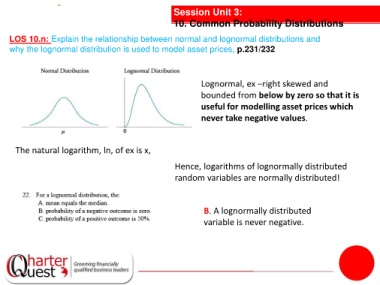

LOS 10.n: Explain the relationship between normal and lognormal distributions and

why the lognormal distribution is used to model asset prices, p.231/232

Lognormal, ex –right skewed and

bounded from below by zero so that it is

useful for modelling asset prices which

never take negative values.

The natural logarithm, ln, of ex is x,

Hence, logarithms of lognormally distributed

random variables are normally distributed!

B. A lognormally distributed

variable is never negative.