Page 103 - FINAL CFA SLIDES DECEMBER 2018 DAY 3

P. 103

Session Unit 3:

10. Common Probability Distributions

LOS 10.o: Distinguish between discretely and continuously compounded rates of return and calculate and

interpret a continuously compounded rate of return, given a specific holding period return, p. 233

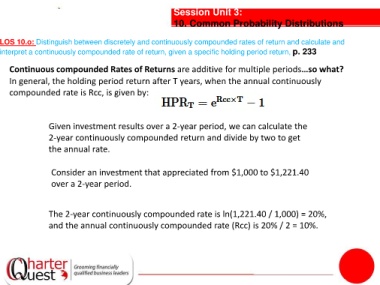

Continuous compounded Rates of Returns are additive for multiple periods…so what?

In general, the holding period return after T years, when the annual continuously

compounded rate is Rcc, is given by:

Given investment results over a 2-year period, we can calculate the

2-year continuously compounded return and divide by two to get

the annual rate.

Consider an investment that appreciated from $1,000 to $1,221.40

over a 2-year period.

The 2-year continuously compounded rate is ln(1,221.40 / 1,000) = 20%,

and the annual continuously compounded rate (Rcc) is 20% / 2 = 10%.