Page 105 - FINAL CFA SLIDES DECEMBER 2018 DAY 3

P. 105

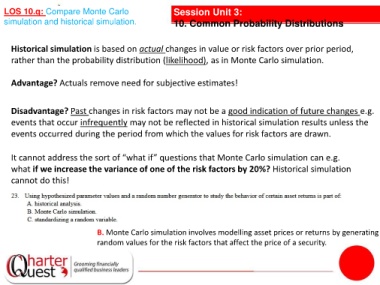

LOS 10.q: Compare Monte Carlo Session Unit 3:

simulation and historical simulation. 10. Common Probability Distributions

Historical simulation is based on actual changes in value or risk factors over prior period,

rather than the probability distribution (likelihood), as in Monte Carlo simulation.

Advantage? Actuals remove need for subjective estimates!

Disadvantage? Past changes in risk factors may not be a good indication of future changes e.g.

events that occur infrequently may not be reflected in historical simulation results unless the

events occurred during the period from which the values for risk factors are drawn.

It cannot address the sort of “what if” questions that Monte Carlo simulation can e.g.

what if we increase the variance of one of the risk factors by 20%? Historical simulation

cannot do this!

B. Monte Carlo simulation involves modelling asset prices or returns by generating

random values for the risk factors that affect the price of a security.