Page 104 - FINAL CFA SLIDES DECEMBER 2018 DAY 3

P. 104

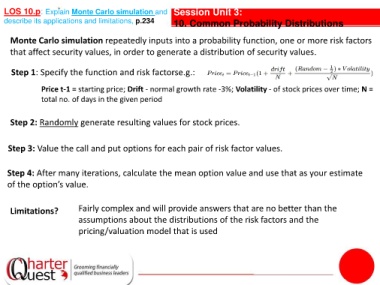

LOS 10.p: Explain Monte Carlo simulation and Session Unit 3:

describe its applications and limitations, p.234 10. Common Probability Distributions

Monte Carlo simulation repeatedly inputs into a probability function, one or more risk factors

that affect security values, in order to generate a distribution of security values.

Step 1: Specify the function and risk factorse.g.:

Price t-1 = starting price; Drift - normal growth rate -3%; Volatility - of stock prices over time; N =

total no. of days in the given period

Step 2: Randomly generate resulting values for stock prices.

Step 3: Value the call and put options for each pair of risk factor values.

Step 4: After many iterations, calculate the mean option value and use that as your estimate

of the option’s value.

Limitations? Fairly complex and will provide answers that are no better than the

assumptions about the distributions of the risk factors and the

pricing/valuation model that is used