Page 24 - P6 Slide Taxation - Lecture Day 4

P. 24

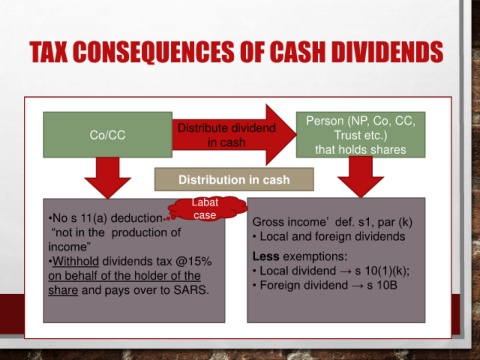

TAX CONSEQUENCES OF CASH DIVIDENDS

Person (NP, Co, CC,

Distribute dividend

Co/CC Trust etc.)

in cash

that holds shares

Distribution in cash

Labat

•No s 11(a) deduction case Gross income’ def. s1, par (k)

“not in the production of • Local and foreign dividends

income”

•Withhold dividends tax @15% Less exemptions:

on behalf of the holder of the • Local dividend → s 10(1)(k);

share and pays over to SARS. • Foreign dividend → s 10B