Page 26 - P6 Slide Taxation - Lecture Day 4

P. 26

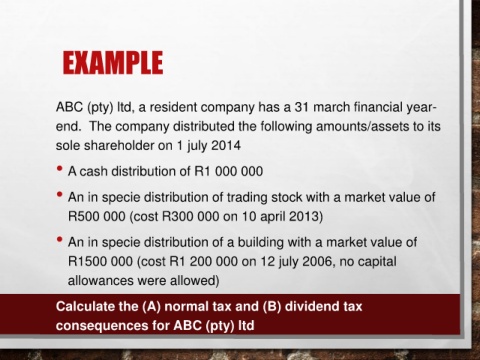

EXAMPLE

ABC (pty) ltd, a resident company has a 31 march financial year-

end. The company distributed the following amounts/assets to its

sole shareholder on 1 july 2014

• A cash distribution of R1 000 000

• An in specie distribution of trading stock with a market value of

R500 000 (cost R300 000 on 10 april 2013)

• An in specie distribution of a building with a market value of

R1500 000 (cost R1 200 000 on 12 july 2006, no capital

allowances were allowed)

Calculate the (A) normal tax and (B) dividend tax

consequences for ABC (pty) ltd