Page 37 - PowerPoint Presentation

P. 37

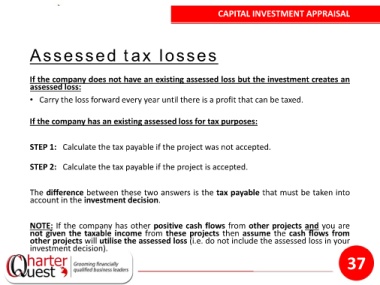

CAPITAL INVESTMENT APPRAISAL

Assessed tax losses

If the company does not have an existing assessed loss but the investment creates an

assessed loss:

• Carry the loss forward every year until there is a profit that can be taxed.

If the company has an existing assessed loss for tax purposes:

STEP 1: Calculate the tax payable if the project was not accepted.

STEP 2: Calculate the tax payable if the project is accepted.

The difference between these two answers is the tax payable that must be taken into

account in the investment decision.

NOTE: If the company has other positive cash flows from other projects and you are

not given the taxable income from these projects then assume the cash flows from

other projects will utilise the assessed loss (i.e. do not include the assessed loss in your

investment decision).

37