Page 33 - PowerPoint Presentation

P. 33

CAPITAL INVESTMENT APPRAISAL

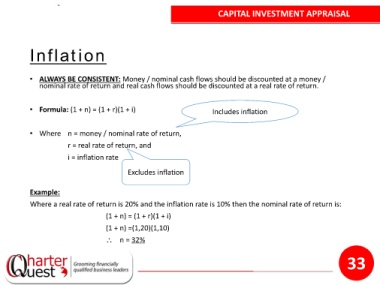

Inflation

• ALWAYS BE CONSISTENT: Money / nominal cash flows should be discounted at a money /

nominal rate of return and real cash flows should be discounted at a real rate of return.

• Formula: (1 + n) = (1 + r)(1 + i) Includes inflation

• Where n = money / nominal rate of return,

r = real rate of return, and

i = inflation rate

Excludes inflation

Example:

Where a real rate of return is 20% and the inflation rate is 10% then the nominal rate of return is:

(1 + n) = (1 + r)(1 + i)

(1 + n) =(1,20)(1,10)

∴ n = 32%

33