Page 28 - PowerPoint Presentation

P. 28

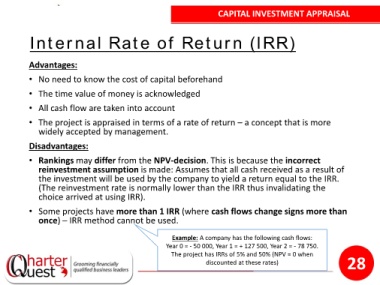

CAPITAL INVESTMENT APPRAISAL

Internal Rate of Return (IRR)

Advantages:

• No need to know the cost of capital beforehand

• The time value of money is acknowledged

• All cash flow are taken into account

• The project is appraised in terms of a rate of return – a concept that is more

widely accepted by management.

Disadvantages:

• Rankings may differ from the NPV-decision. This is because the incorrect

reinvestment assumption is made: Assumes that all cash received as a result of

the investment will be used by the company to yield a return equal to the IRR.

(The reinvestment rate is normally lower than the IRR thus invalidating the

choice arrived at using IRR).

• Some projects have more than 1 IRR (where cash flows change signs more than

once) – IRR method cannot be used.

Example: A company has the following cash flows:

Year 0 = - 50 000, Year 1 = + 127 500, Year 2 = - 78 750.

The project has IRRs of 5% and 50% (NPV = 0 when

discounted at these rates) 28