Page 29 - PowerPoint Presentation

P. 29

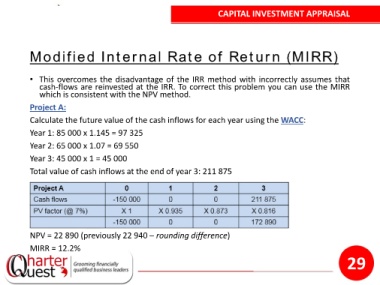

CAPITAL INVESTMENT APPRAISAL

Modified Internal Rate of Return (MIRR)

• This overcomes the disadvantage of the IRR method with incorrectly assumes that

cash-flows are reinvested at the IRR. To correct this problem you can use the MIRR

which is consistent with the NPV method.

Project A:

Calculate the future value of the cash inflows for each year using the WACC:

Year 1: 85 000 x 1.145 = 97 325

Year 2: 65 000 x 1.07 = 69 550

Year 3: 45 000 x 1 = 45 000

Total value of cash inflows at the end of year 3: 211 875

NPV = 22 890 (previously 22 940 – rounding difference)

MIRR = 12.2%

29