Page 27 - PowerPoint Presentation

P. 27

CAPITAL INVESTMENT APPRAISAL

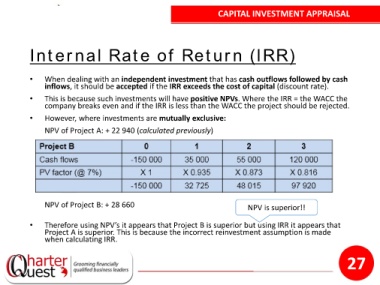

Internal Rate of Return (IRR)

• When dealing with an independent investment that has cash outflows followed by cash

inflows, it should be accepted if the IRR exceeds the cost of capital (discount rate).

• This is because such investments will have positive NPVs. Where the IRR = the WACC the

company breaks even and if the IRR is less than the WACC the project should be rejected.

• However, where investments are mutually exclusive:

NPV of Project A: + 22 940 (calculated previously)

NPV of Project B: + 28 660 NPV is superior!!

• Therefore using NPV’s it appears that Project B is superior but using IRR it appears that

Project A is superior. This is because the incorrect reinvestment assumption is made

when calculating IRR.

27