Page 31 - PowerPoint Presentation

P. 31

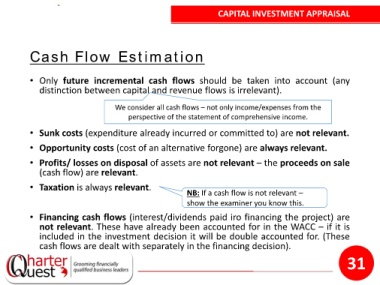

CAPITAL INVESTMENT APPRAISAL

Cash Flow Estimation

• Only future incremental cash flows should be taken into account (any

distinction between capital and revenue flows is irrelevant).

We consider all cash flows – not only income/expenses from the

perspective of the statement of comprehensive income.

• Sunk costs (expenditure already incurred or committed to) are not relevant.

• Opportunity costs (cost of an alternative forgone) are always relevant.

• Profits/ losses on disposal of assets are not relevant – the proceeds on sale

(cash flow) are relevant.

• Taxation is always relevant.

NB: If a cash flow is not relevant –

show the examiner you know this.

• Financing cash flows (interest/dividends paid iro financing the project) are

not relevant. These have already been accounted for in the WACC – if it is

included in the investment decision it will be double accounted for. (These

cash flows are dealt with separately in the financing decision).

31