Page 34 - PowerPoint Presentation

P. 34

CAPITAL INVESTMENT APPRAISAL

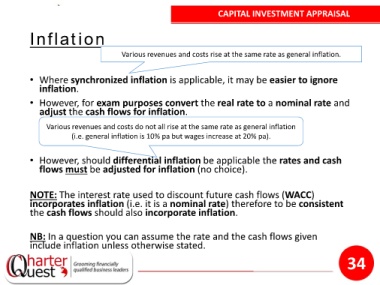

Inflation

Various revenues and costs rise at the same rate as general inflation.

• Where synchronized inflation is applicable, it may be easier to ignore

inflation.

• However, for exam purposes convert the real rate to a nominal rate and

adjust the cash flows for inflation.

Various revenues and costs do not all rise at the same rate as general inflation

(i.e. general inflation is 10% pa but wages increase at 20% pa).

• However, should differential inflation be applicable the rates and cash

flows must be adjusted for inflation (no choice).

NOTE: The interest rate used to discount future cash flows (WACC)

incorporates inflation (i.e. it is a nominal rate) therefore to be consistent

the cash flows should also incorporate inflation.

NB: In a question you can assume the rate and the cash flows given

include inflation unless otherwise stated.

34