Page 30 - PowerPoint Presentation

P. 30

CAPITAL INVESTMENT APPRAISAL

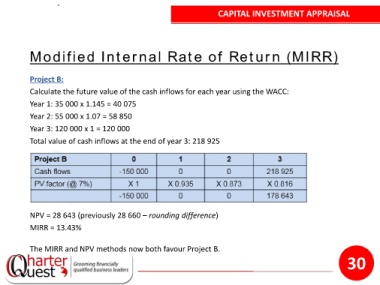

Modified Internal Rate of Return (MIRR)

Project B:

Calculate the future value of the cash inflows for each year using the WACC:

Year 1: 35 000 x 1.145 = 40 075

Year 2: 55 000 x 1.07 = 58 850

Year 3: 120 000 x 1 = 120 000

Total value of cash inflows at the end of year 3: 218 925

NPV = 28 643 (previously 28 660 – rounding difference)

MIRR = 13.43%

The MIRR and NPV methods now both favour Project B.

30