Page 26 - PowerPoint Presentation

P. 26

CAPITAL INVESTMENT APPRAISAL

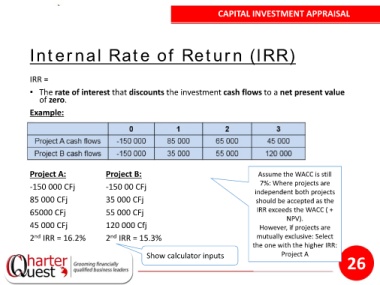

Internal Rate of Return (IRR)

IRR =

• The rate of interest that discounts the investment cash flows to a net present value

of zero.

Example:

Project A: Project B: Assume the WACC is still

7%: Where projects are

-150 000 CFj -150 00 CFj independent both projects

85 000 CFj 35 000 CFj should be accepted as the

65000 CFj 55 000 CFj IRR exceeds the WACC ( +

NPV).

45 000 CFj 120 000 Cfj However, if projects are

2 IRR = 16.2% 2 IRR = 15.3% mutually exclusive: Select

nd

nd

the one with the higher IRR:

Show calculator inputs Project A

26