Page 22 - PowerPoint Presentation

P. 22

CAPITAL INVESTMENT APPRAISAL

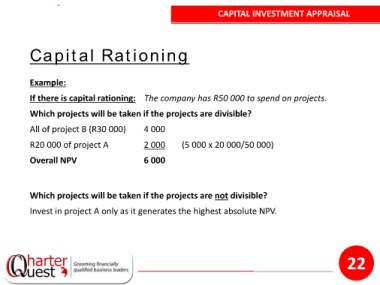

Capital Rationing

Example:

If there is capital rationing: The company has R50 000 to spend on projects.

Which projects will be taken if the projects are divisible?

All of project B (R30 000) 4 000

R20 000 of project A 2 000 (5 000 x 20 000/50 000)

Overall NPV 6 000

Which projects will be taken if the projects are not divisible?

Invest in project A only as it generates the highest absolute NPV.

22