Page 17 - PowerPoint Presentation

P. 17

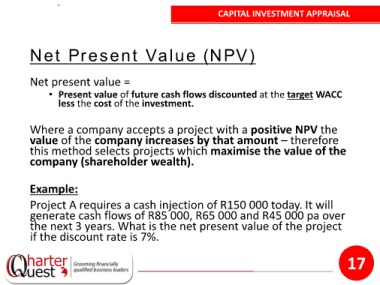

CAPITAL INVESTMENT APPRAISAL

Net Present Value (NPV)

Net present value =

• Present value of future cash flows discounted at the target WACC

less the cost of the investment.

Where a company accepts a project with a positive NPV the

value of the company increases by that amount – therefore

this method selects projects which maximise the value of the

company (shareholder wealth).

Example:

Project A requires a cash injection of R150 000 today. It will

generate cash flows of R85 000, R65 000 and R45 000 pa over

the next 3 years. What is the net present value of the project

if the discount rate is 7%.

17