Page 19 - PowerPoint Presentation

P. 19

CAPITAL INVESTMENT APPRAISAL

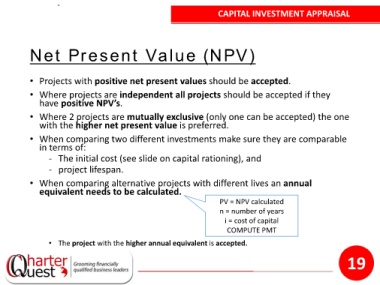

Net Present Value (NPV)

• Projects with positive net present values should be accepted.

• Where projects are independent all projects should be accepted if they

have positive NPV’s.

• Where 2 projects are mutually exclusive (only one can be accepted) the one

with the higher net present value is preferred.

• When comparing two different investments make sure they are comparable

in terms of:

- The initial cost (see slide on capital rationing), and

- project lifespan.

• When comparing alternative projects with different lives an annual

equivalent needs to be calculated.

PV = NPV calculated

n = number of years

i = cost of capital

COMPUTE PMT

• The project with the higher annual equivalent is accepted.

19