Page 20 - PowerPoint Presentation

P. 20

CAPITAL INVESTMENT APPRAISAL

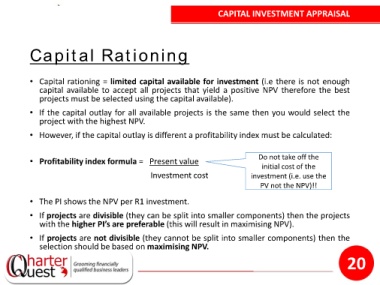

Capital Rationing

• Capital rationing = limited capital available for investment (i.e there is not enough

capital available to accept all projects that yield a positive NPV therefore the best

projects must be selected using the capital available).

• If the capital outlay for all available projects is the same then you would select the

project with the highest NPV.

• However, if the capital outlay is different a profitability index must be calculated:

• Profitability index formula = Present value Do not take off the

initial cost of the

Investment cost investment (i.e. use the

PV not the NPV)!!

• The PI shows the NPV per R1 investment.

• If projects are divisible (they can be split into smaller components) then the projects

with the higher PI’s are preferable (this will result in maximising NPV).

• If projects are not divisible (they cannot be split into smaller components) then the

selection should be based on maximising NPV.

20