Page 32 - PowerPoint Presentation

P. 32

CAPITAL INVESTMENT APPRAISAL

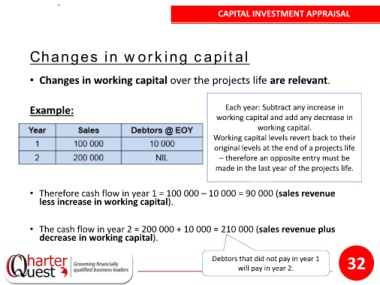

Changes in working capital

• Changes in working capital over the projects life are relevant.

Example: Each year: Subtract any increase in

working capital and add any decrease in

working capital.

Working capital levels revert back to their

original levels at the end of a projects life

– therefore an opposite entry must be

made in the last year of the projects life.

• Therefore cash flow in year 1 = 100 000 – 10 000 = 90 000 (sales revenue

less increase in working capital).

• The cash flow in year 2 = 200 000 + 10 000 = 210 000 (sales revenue plus

decrease in working capital).

Debtors that did not pay in year 1 32

will pay in year 2.