Page 13 - PowerPoint Presentation

P. 13

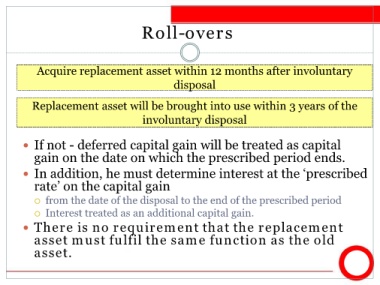

Roll-overs

Acquire replacement asset within 12 months after involuntary

disposal

Replacement asset will be brought into use within 3 years of the

involuntary disposal

If not - deferred capital gain will be treated as capital

gain on the date on which the prescribed period ends.

In addition, he must determine interest at the ‘prescribed

rate’ on the capital gain

from the date of the disposal to the end of the prescribed period

Interest treated as an additional capital gain.

There is no requirement that the replacement

asset must fulfil the same function as the old

asset.