Page 14 - PowerPoint Presentation

P. 14

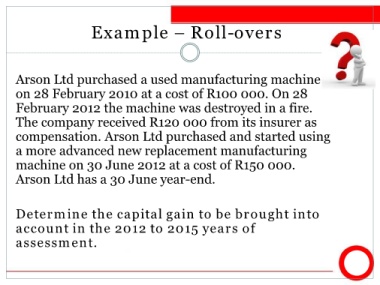

Example – Roll-overs

Arson Ltd purchased a used manufacturing machine

on 28 February 2010 at a cost of R100 000. On 28

February 2012 the machine was destroyed in a fire.

The company received R120 000 from its insurer as

compensation. Arson Ltd purchased and started using

a more advanced new replacement manufacturing

machine on 30 June 2012 at a cost of R150 000.

Arson Ltd has a 30 June year-end.

Determine the capital gain to be brought into

account in the 2012 to 2015 years of

assessment.