Page 15 - PowerPoint Presentation

P. 15

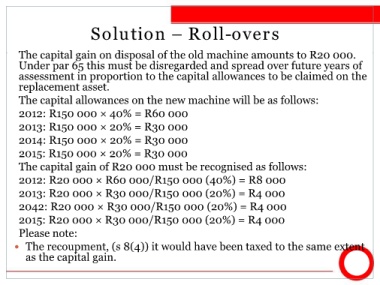

Solution – Roll-overs

The capital gain on disposal of the old machine amounts to R20 000.

Under par 65 this must be disregarded and spread over future years of

assessment in proportion to the capital allowances to be claimed on the

replacement asset.

The capital allowances on the new machine will be as follows:

2012: R150 000 × 40% = R60 000

2013: R150 000 × 20% = R30 000

2014: R150 000 × 20% = R30 000

2015: R150 000 × 20% = R30 000

The capital gain of R20 000 must be recognised as follows:

2012: R20 000 × R60 000/R150 000 (40%) = R8 000

2013: R20 000 × R30 000/R150 000 (20%) = R4 000

2042: R20 000 × R30 000/R150 000 (20%) = R4 000

2015: R20 000 × R30 000/R150 000 (20%) = R4 000

Please note:

The recoupment, (s 8(4)) it would have been taxed to the same extent

as the capital gain.