Page 12 - AB INBEV 2018 Model Answer 2

P. 12

P a g e | 12

Actions: Whilst awaiting the results of the operational audit, key actions include: increased focus on

sources of short-term sub-contracting of delivery trucks for Rongcheng city depot and rewarding of the

top performing depots (especially Menzhi) for meeting the existing KPA targets. Incorporate weights

to each KPA area, giving the largest weight to ‘Competitiveness’ as well as ‘Quality, Flexibility &

‘Resource Utilisation’, to better capture the increased emphasis of strengthening our distribution

system, in the wake of the Heineken threats.

th

5 Priority: Innovation Strategy

This is a strategic opportunity in our SWOT, embedded with strategic weaknesses in our internal

systems and processes. We are seeking to introduce new technologies that will not only address the

previous SABMiller weaknesses in respect of its ‘B2B and Downstream Supply Chain Strategy’, but

correct a number of internal productivity challenges, boost global sales by still venturing into direct e-

commerce retailing; and exploit the resulting big data opportunities brought about by rapid expansion

of digital technologies. The board needs to decide between launching our own e-commerce website,

rd

or, exploiting 3 party ecommerce platforms offered by global giants such as Amazon; or whether

it is not too risky to dare any -at all, as supermarkets might fight back!

Although taken as mutually exclusive, both strategies, in the real world, need not be the case. We

examine each option in the table below:

rd

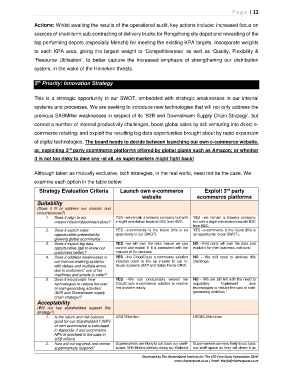

Strategy Evaluation Criteria Launch own e-commerce Exploit 3 party

website ecommerce platforms

Suitability

(Does it fit or address our mission and

circumstances?)

1. Does it align to our YES –we remain a brewery company but with YES –we remain a brewery company

mission/vision/objectives/values? a slight orientation towards B2C from B2C. but with a slight orientation towards B2C

from B2C.

2. Does it exploit sales YES –e-commerce is the future (this is an YES –e-commerce is the future (this is

opportunities presented by opportunity in our SWOT). an opportunity in our SWOT).

growing global ecommerce

3. Does it exploit big data YES –we will own the data -hence we can NO –third party will own the data and

opportunities (get to know our control and exploit it! It is consistent with the exploit it for their business, not ours!

customers better)? mission of Zx ventures.

4. Does it address weaknesses in YES –the CloudCraze e-commerce solution NO – We still need to address this

our manual ordering systems - includes costs to link up e-sales to our in- challenge.

with delays and multiple errors house systems (SAP and Sales Force CRM)

due to customers’ use of fax

machines and emails to order?

5. Does it incorporate ‘new YES –We can presumably extend the NO – We are still left with the need to

technologies to reduce the cost CloudCraze e-commerce solution to resolve separately ‘implement new

of cost-generating activities’ this problem easily. technologies to reduce the cost of cost-

(B2B and Downstream supply generating activities.’

chain strategy)?

Acceptability

(Will our key stakeholders support this

strategy?)

1. Is the return and risk balance USD759million USD$5,201million

good for our shareholders? (NPV

of own ecommerce is calculated

in Appendix 3 and ecommerce

NPV is provided in the case in

US$ million)

2. How will our big brick and mortar Supermarkets are likely to cut back our shelf- Supermarkets are less likely to cut back

supermarkets respond? space. With Makro already doing so, Walmart our shelf-space as they will deem it as

Developed by The CharterQuest Institute for 'The CFO Case Study Competition 2018'

www.charterquest.co.za | Email: thecfo@charterquest.co.za