Page 428 - F2 Integrated Workbook STUDENT 2019

P. 428

Chapter 19

Chapter 6

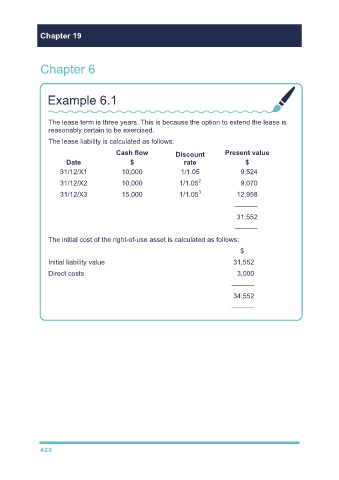

Example 6.1

The lease term is three years. This is because the option to extend the lease is

reasonably certain to be exercised.

The lease liability is calculated as follows:

Cash flow Discount Present value

Date $ rate $

31/12/X1 10,000 1/1.05 9,524

31/12/X2 10,000 1/1.05 2 9,070

31/12/X3 15,000 1/1.05 3 12,958

––––––

31,552

––––––

The initial cost of the right-of-use asset is calculated as follows:

$

Initial liability value 31,552

Direct costs 3,000

––––––

34,552

––––––

420