Page 430 - F2 Integrated Workbook STUDENT 2019

P. 430

Chapter 19

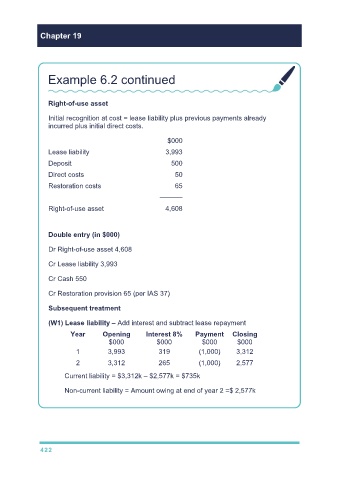

Example 6.2 continued

Right-of-use asset

Initial recognition at cost = lease liability plus previous payments already

incurred plus initial direct costs.

$000

Lease liability 3,993

Deposit 500

Direct costs 50

Restoration costs 65

––––––

Right-of-use asset 4,608

Double entry (in $000)

Dr Right-of-use asset 4,608

Cr Lease liability 3,993

Cr Cash 550

Cr Restoration provision 65 (per IAS 37)

Subsequent treatment

(W1) Lease liability – Add interest and subtract lease repayment

Year Opening Interest 8% Payment Closing

$000 $000 $000 $000

1 3,993 319 (1,000) 3,312

2 3,312 265 (1,000) 2,577

Current liability = $3,312k – $2,577k = $735k

Non-current liability = Amount owing at end of year 2 =$ 2,577k

422