Page 434 - F2 Integrated Workbook STUDENT 2019

P. 434

Chapter 19

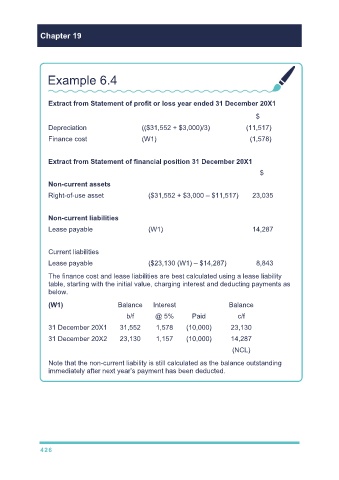

Example 6.4

Extract from Statement of profit or loss year ended 31 December 20X1

$

Depreciation (($31,552 + $3,000)/3) (11,517)

Finance cost (W1) (1,578)

Extract from Statement of financial position 31 December 20X1

$

Non-current assets

Right-of-use asset ($31,552 + $3,000 – $11,517) 23,035

Non-current liabilities

Lease payable (W1) 14,287

Current liabilities

Lease payable ($23,130 (W1) – $14,287) 8,843

The finance cost and lease liabilities are best calculated using a lease liability

table, starting with the initial value, charging interest and deducting payments as

below.

(W1) Balance Interest Balance

b/f @ 5% Paid c/f

31 December 20X1 31,552 1,578 (10,000) 23,130

31 December 20X2 23,130 1,157 (10,000) 14,287

(NCL)

Note that the non-current liability is still calculated as the balance outstanding

immediately after next year’s payment has been deducted.

426