Page 433 - F2 Integrated Workbook STUDENT 2019

P. 433

Answers

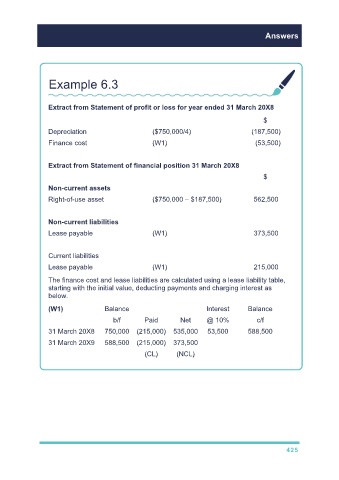

Example 6.3

Extract from Statement of profit or loss for year ended 31 March 20X8

$

Depreciation ($750,000/4) (187,500)

Finance cost (W1) (53,500)

Extract from Statement of financial position 31 March 20X8

$

Non-current assets

Right-of-use asset ($750,000 – $187,500) 562,500

Non-current liabilities

Lease payable (W1) 373,500

Current liabilities

Lease payable (W1) 215,000

The finance cost and lease liabilities are calculated using a lease liability table,

starting with the initial value, deducting payments and charging interest as

below.

(W1) Balance Interest Balance

b/f Paid Net @ 10% c/f

31 March 20X8 750,000 (215,000) 535,000 53,500 588,500

31 March 20X9 588,500 (215,000) 373,500

(CL) (NCL)

425