Page 436 - F2 Integrated Workbook STUDENT 2019

P. 436

Chapter 19

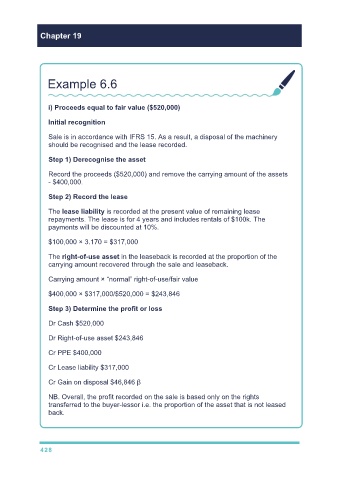

Example 6.6

i) Proceeds equal to fair value ($520,000)

Initial recognition

Sale is in accordance with IFRS 15. As a result, a disposal of the machinery

should be recognised and the lease recorded.

Step 1) Derecognise the asset

Record the proceeds ($520,000) and remove the carrying amount of the assets

- $400,000.

Step 2) Record the lease

The lease liability is recorded at the present value of remaining lease

repayments. The lease is for 4 years and includes rentals of $100k. The

payments will be discounted at 10%.

$100,000 × 3.170 = $317,000

The right-of-use asset in the leaseback is recorded at the proportion of the

carrying amount recovered through the sale and leaseback.

Carrying amount × “normal” right-of-use/fair value

$400,000 × $317,000/$520,000 = $243,846

Step 3) Determine the profit or loss

Dr Cash $520,000

Dr Right-of-use asset $243,846

Cr PPE $400,000

Cr Lease liability $317,000

Cr Gain on disposal $46,846 β

NB. Overall, the profit recorded on the sale is based only on the rights

transferred to the buyer-lessor i.e. the proportion of the asset that is not leased

back.

428