Page 431 - F2 Integrated Workbook STUDENT 2019

P. 431

Answers

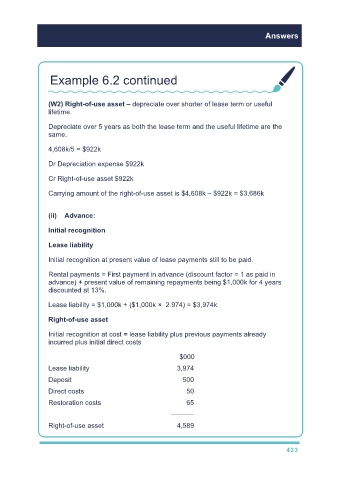

Example 6.2 continued

(W2) Right-of-use asset – depreciate over shorter of lease term or useful

lifetime.

Depreciate over 5 years as both the lease term and the useful lifetime are the

same.

4,608k/5 = $922k

Dr Depreciation expense $922k

Cr Right-of-use asset $922k

Carrying amount of the right-of-use asset is $4,608k – $922k = $3,686k

(ii) Advance:

Initial recognition

Lease liability

Initial recognition at present value of lease payments still to be paid.

Rental payments = First payment in advance (discount factor = 1 as paid in

advance) + present value of remaining repayments being $1,000k for 4 years

discounted at 13%.

Lease liability = $1,000k + ($1,000k × 2.974) = $3,974k

Right-of-use asset

Initial recognition at cost = lease liability plus previous payments already

incurred plus initial direct costs

$000

Lease liability 3,974

Deposit 500

Direct costs 50

Restoration costs 65

––––––

Right-of-use asset 4,589

423